In the United States, the cost of living is rather high. Los Angeles, San Francisco, Boston, Honolulu, Washington, D.C., and New York are among the most expensive cities as of 2022. Despite the high earnings, before relocating to the United States, one should make plans and estimate the cost of living.

All your costs, such as housing, food, utilities, and insurance, are considered your cost of living. To put it simply, it is the price of living. When deciding where to reside, determining the cost of living in a region is essential.

Hawaii, the District of Columbia, New York, Massachusetts, and California are the states where the cost of living is the greatest. The lowest cost of living may be found in Tennessee, Mississippi, Arkansas, New Mexico, and Oklahoma.

In the United States, How Is the Typical Person’s Money Spent?

For the average person in the United States, bills and basic necessities can take up much of an individual’s earned income. But what are those expenses, and can payday loan companies take you to court if you can’t make your payments or is it better to cut expenses instead? To consider that let’s first figure out the average monthly expenses list.

Generally speaking, items such as food, rent or mortgage payments, utilities, taxes, insurance premiums, and car payments can all make up a significant portion of a typical household’s expenses. Of course, there can also be some elements of discretionary spending associated with clothing, entertainment, and even travel.

When it comes to payday loans, however, laws can indicate that lenders cannot file criminal actions against you for nonpayment; instead, they must rely on civil courts to demand payment or take other measures.

Average Monthly Costs for Each Family

In 2021, the average monthly cost for a single consumer unit was $5,577. Meanwhile, annual spending averaged $66,928.

Keep in mind that the costs of living might vary based on where you reside; some cities are less costly to live in than others. These figures represent national averages.

After shrinking in 2019, American spending resumed its annual upward trend in 2021, growing by an average of 9%.

What constitutes a consumer unit may be in question. Any of the following is what the BLS classifies as a consumer unit:

- Families,

- Solitary individuals living alone,

- Solitary individuals cohabit with others while maintaining their financial independence,

- Two or more people cohabit and split significant expenditures.

Two parents and a child, for example, would constitute one consumer unit. as well as three roommates and three consumer units. The average consumer unit consists of 2.5 people. Interestingly, according to surveys, Americans believe that the cost of living in the country is very high.

Health

In the United States, national healthcare spending is anticipated to increase at an average annual rate of 5.4% from 2019 to 2028, compared to a 4.3% average annual growth rate. The amount spent on national healthcare amounted to $3.81 trillion in 2019 and will rise to $4.01 trillion in 2020.

The Centers for Medicare and Medicaid Services predicted that, up from 17.7% in 2018, healthcare spending will increase to $6.19 trillion by 2028 and represent 19.7% of GDP. Healthcare in the United States is among the most expensive in the world, costing an estimated $121,000 per person in 2020.

Transportation

Since you must commute since your location of residence is far from your workplace, transportation costs are high here.

Americans frequently drive, and it is a part of their way of life, but you should be aware that owning and operating one daily might significantly strain your financial situation.

Utilities

Your entire cost of living is significantly influenced by the amount of rent you pay, which does not include utilities. You’ll need to increase the rent by at least $200 to cover basic expenses.

Although many variables affect these expenses, it can be claimed that an Internet connection is often rather expensive.

Shoes and Clothing

Your ability to pay all of your payments and set some money away will determine whether you have adequate money for clothing.

The fact that just 2% of monthly income is allocated for clothing is due to the difficulty people at minimum wage will have purchasing clothing, which is quite expensive.

Increasing Prices and Inflation

Inflation has an impact on everyone’s cost of living in America. Inflation, which is a loss in the purchasing power of our money, is shown by a general increase in the price of products and services.

Inflation may occur when prices increase as a consequence of increased costs associated with manufacturing, such as raw materials and labor, or when consumer demand for products and services increases, indicating that consumers are willing to pay more for them.

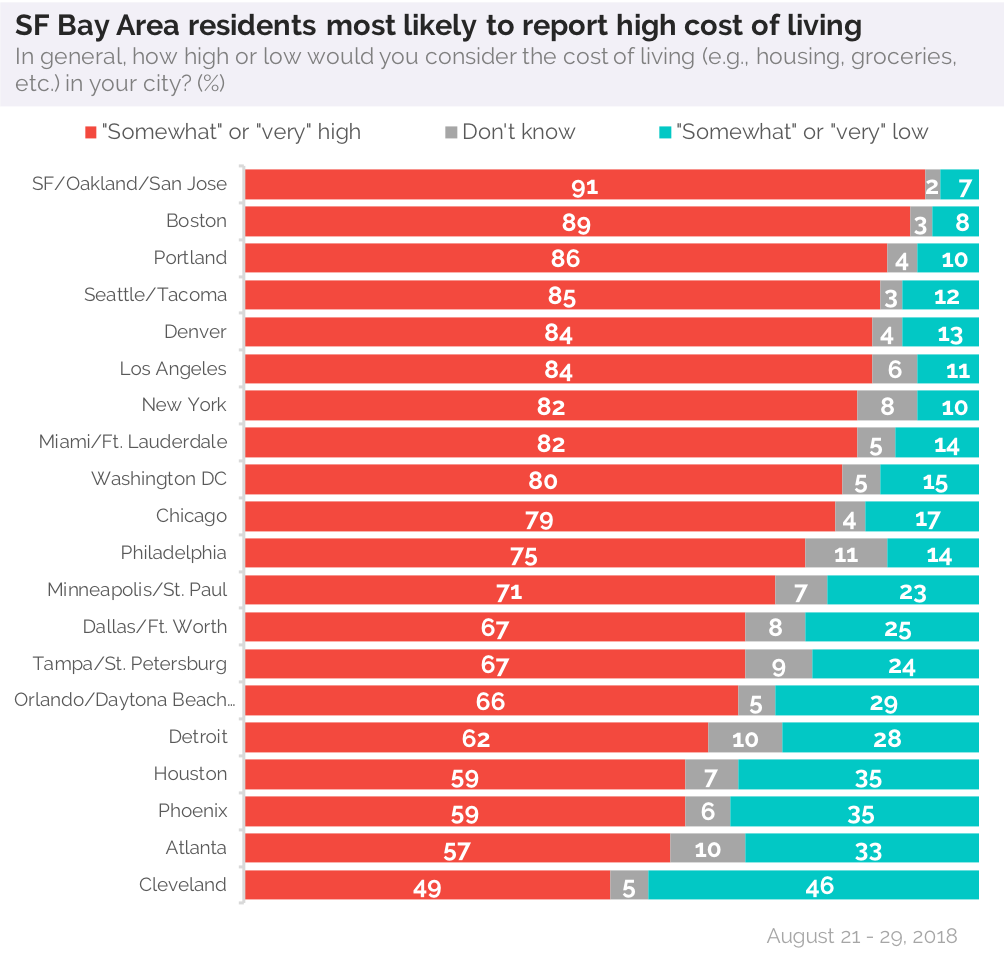

Inflation is currently at a rate of about 7%. Therefore, a $1 pencil today would cost $1.07 in 2020. That is inflation in action. A survey conducted among residents of large US cities showed that San Francisco, Oakland, and San Jose are the most expensive cities to live in, according to their residents.

Monthly Average Income

According to the report, the average consumer unit income in 2020 was $84,352, or $7,029 per month. The statistic represents earnings before taxes, thus the average monthly take-home pay is lower after taxes are taken out.

The regionality, or location, of a household’s wages, has a significant impact on its purchasing power. For instance, New York City has a far higher cost of living than Cleveland.

Americans who live in less costly locations could be able to increase their average savings since they frequently spend less money each month, but it might be harder to save in locations with higher costs of living. In areas with reduced cost of living, salaries may also be lower and there may be fewer career options available.

Conclusion

Immigrants have always been drawn to America throughout history because of the possibilities offered there. Therefore, it comes as no surprise that many foreigners continue to take the risk and relocate permanently to the United States.

Whether you’re wanting to relocate permanently or simply for a year or two to travel, the US is an excellent choice for ex-pats. But traveling to the USA might be costly as well. It is good to investigate the cost of living in the USA beforehand and see where you can save costs.